SBI saw a 74 jump in its net profit in the period, the number was 89 for Canara Bank( ₹,525 crore), 145 for UCO Bank( ₹ 504 crore),58.7 for Bank of Baroda at ₹ crore, and 12 for Indian Bank at ₹,225 crore.

|

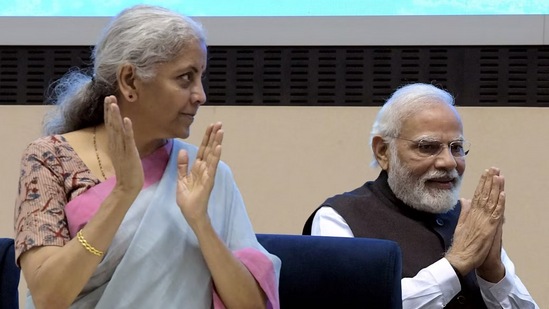

| Prime Minister Narendra Modi with Union finance minister Nirmala Sitharaman. |

India’s public sector banks( PSBs) have seen a reversal in performance and quality of means, experts said, pointing to the robust performance of the country’s 12 PSBs and especially State Bank of India’s( SBI’s) record ₹ crore net profit in the alternate quarter of 2022- 23 compared to a net loss of ₹,547 crore in FY18.

The government’s decision to launch an asset quality review( AQR) on April 2015 to unearth retirednon-performing means( NPAs) was the first major step in strengthening the Indian banking sector, dominated by PSBs, five experts said, adding that the results are now being seen.

Union finance minister Nirmala Sitharaman twittered on November 7 “ The nonstop sweats of our govt for reducing the NPAs & farther strengthening the health of PSBs are now showing palpable results. All 12 PSBs declared net profit of ₹,685 cr in Q2FY23 & aggregate ₹,991 cr in H1FY23, over by 50 &31.6, independently( y- o- y). ”

SBI saw a 74 jump in its net profit in the period, the number was 89 for Canara Bank( ₹,525 crore), 145 for UCO Bank( ₹ 504 crore),58.7 for Bank of Baroda at ₹ crore, and 12 for Indian Bank at ₹,225 crore. Stocks of numerous PSBs, including SBI, surged to 52- week highs that day. Anand Dama, elderly exploration critic at Emkay Global Financial Services Ltd said SBI made a strong comeback in the quarter “ on the reverse of robust credit growth, sharp periphery supplement and lower LLP( loan loss vittles) ”.

Prime Minister Narendra Modi devoted digital banking units( DBU) to the nation on October 16 and spoke of the transition from unskillful “ phone banking ”( loans granted to those with political connections) to reuse- driven decision- making grounded on marketable considerations. “ The frugality of a country is as progressive as the strength of its banking system. moment, India’s frugality is moving forward with a continuum, ” he said.

The 2015 AQR saw a swell in NPAs of PSBs from ₹2.17 lakh crore on March 31, 2014 to ₹8.96 lakh crore on March 31, 2018 substantially due to magpie lending.

Since also, SBI’s net NPAs have fallen below 1( of advances) at0.80 in Q2 of FY23; this was5.73 in FY18. In Q2 of FY23, the net NPA of Canara Bank was down by1.02 chance points at2.19 compared to the same quarter a time ago at3.21, and significantly down from7.48 in March 2018. Other banks also saw a sharp decline in NPAs. The net NPA of Indian Bank reduced by1.76 chance points to1.50 in Q2 FY23 from3.26 in the same period former time.

Gayathri Parthasarathy, mate and leader of fiscal services at PwC India said NPA issues were the pain point for PSBs, but this is now a matter of history after a focused “ clean- up ” of the stressed-out books. As commercial gains are now perfecting along with robust profitable growth, public sector banks are seeing a return to profitability, she said.

“ Financialization of ménage wealth, adding investments into fiscal means rather of physical means – helping strengthen liability/ deposits ballot and thereby perfecting cost of finances, ” she added.

Aashay Choksey, Vice President & Sector Head- Financial Sector Conditions at ICRA said the banking sector has also served from interventions similar as doldrums, Emergency Credit Line Guarantee Scheme( ECLGS) and restructuring blazoned during the Covid period.

“ also, PSBs, which were floundering previous to the onset of the epidemic on multiple fronts, including weaker capitalisation situations and losses, were backed by a meaningful recapitalisation programme.

This led to the shoring up of the provision cover on NPAs, wider capital cocoons as well as an enhancement in the solvency profile, ” he added.

Experts said government’s policy reforms of entire fiscal sector helped in making fiscal institutions strong. “ Akin to PSBs, private banks and NBFCs have also been aggressive on quality lending both in the institutional and retail space, ” said Karan Mitroo, mate, Luthra & Luthra Law services India.

Experts are also confident about better performance by private banks. “ Private banks are more effective in profit maximisation. Private sectors banks( especially large bones like HDFC, ICICI), feel to have outperformed in the banking space with massive growth in still gains( HDFC earned net profit of ₹ crore), ” according to Parthasarathy.

Choksey said private sector banks continue to witness strong growth and enhancement in the caption asset quality criteria and profitability, with the exception of a manymid-sized banks that are dealing with seasonally advanced or episodic harpoons in slippages. “ also, private banks are largely well capitalised and well placed to grow without demanding to raise capital in the near term, ” he said.

BY BANK NEWS INDIA ☝